Page Contents Table

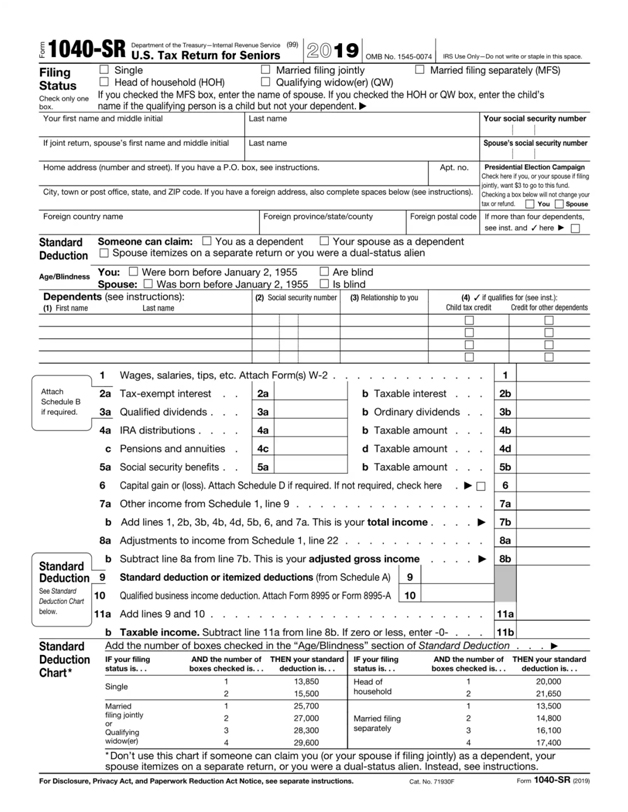

Do seniors get a tax break in 2019? The answer is ‘YES’, the Internal Revenue Service launched a new tax form, Form 1040-SR, specifically for senior taxpayers in the United States. With the availability of new Form 1040-SR for seniors, older American citizens can easily read and use the form with larger print and a standard deduction chart.

Furthermore, those seniors who are 65 or over in age are eligible to fill out Form 1040-SR. not only this, Married senior taxpayers who file a joint return can use the Form 1040-SR regardless of whether one or both spouses are age 65 or older or retired. Must take the standard deduction into the consideration when filling Form 1040-SR as those senior taxpayers who are 65 or over are entitled to a higher deduction. For further details, check the complete post below:

New Form 1040 SR available to download:

Who Can File Form 1040-SR?

The new Tax Form 1040-SR is a simplified tax form that is designed for seniors with uncomplicated finances. Those senior taxpayers who have turned 65 or older by December 31, 2019 or by the end of the tax filing year are eligible to file Form 1040-SR. for reporting their income from wages, salaries, tips, and other income sources, Form 1040-SR is filed out. Some of the major features of new Form 1040-SR include no income testes, expanded income categories, larger font size, better readability as well as proper spaces for filling information.

What Are Tax Deductions for Seniors in Form 1040-SR?

On the first page, Form 1040-SR features a chart that shows details of standard deductions on the basis of filing status. A higher deduction is allowed for those who are 65 or over. If the taxpayer is 65 or older plus single in 2019, additional standard deduction of $1,650 is allowed, totaling $13,850 for tax year 2019. Standard deduction goes up $1,300 if the taxpayer is married filing jointly and one of the spouses is 65 or older. If both of the spouses are 65 or older, the standard deduction increases by $2,600. The standard deduction for those who are 65 and older remains the same for the tax year 2020.

1040-SR: The New Tax Return Form for Seniors:

- The IRS created a tax form for seniors as per the guidance of The Bipartisan Budget Act of 2018. Seniors taxpayers age 65 or older can utilize the option of filing Form 1040-SR, U.S. Tax Return for Seniors.

- Those taxpayers who are born before January 2, 1955 are eligible to use Form 1040-SR whether they are working, not working or retired. To file Form 1040-SR, it is necessary to report income from other sources common to seniors. These sources include Social Security, investment income as well as distributions from qualified retirement plans, annuities or related deferred-payment arrangements.

- To file 2019 federal income tax return, seniors can use Form 1040-SR within the due date of April 15, 2020.

- If you see closely, lines and check boxes on Form 1040-SR are similar the Form 1040. Not only this. Same attached schedules and forms are incorporated in both of the forms. Go though the 2019 Instructions that cover both Forms 1040 and 1040-SR.

- Eligible seniors American taxpayers can use Form 1040-SR for itemized deduction planning as well as for taking the standard deduction.

- Those taxpayers who want to itemize deductions during filing returns can file Form 1040-SR with a Schedule A, Itemized Deductions.

- Those taxpayers who want to take the standard deduction can take assistance from a chart on Form 1040-SR that lists the standard deduction amounts for easy calculations.

- The standard deduction gets increased if the senior taxpayers age 65 and older.

If you are having any problem in filing the new Tax Form 1040-SR, you can ask for Black Ink professional assistance. From retirement planning to tax preparation, we offer a complete catalog of accounting and taxation services in USA.