Table of Contents

Federal payroll tax withholding chart 2024-25 and employer guidance.

What are the federal payroll tax withholding chart 2024-25 all about?

The federal payroll tax withholding chart 2024-25-25 provide you with the estimated figure it takes for an employer to withhold from an employee paychecks for the tax year. This incorporates payroll tax, income taxes and other taxes like Medicare and Social Security Taxes as well.

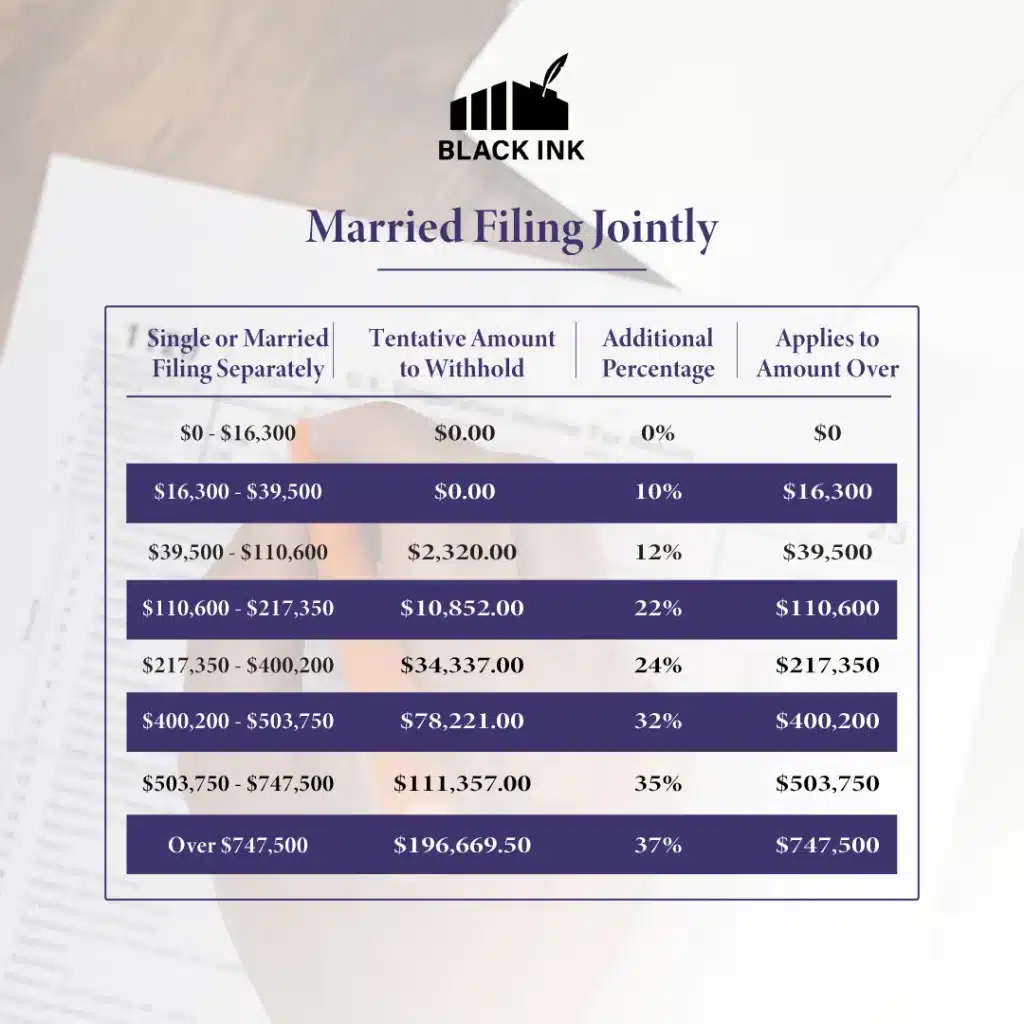

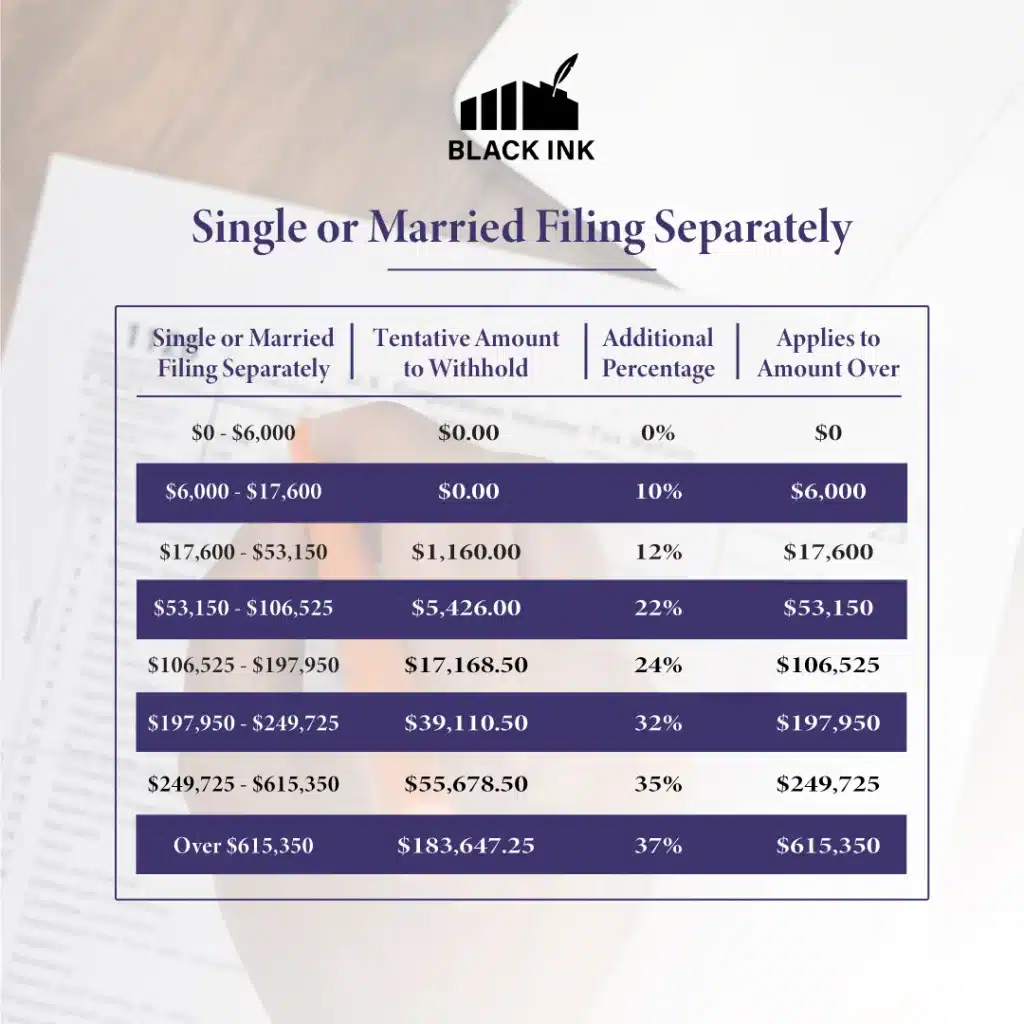

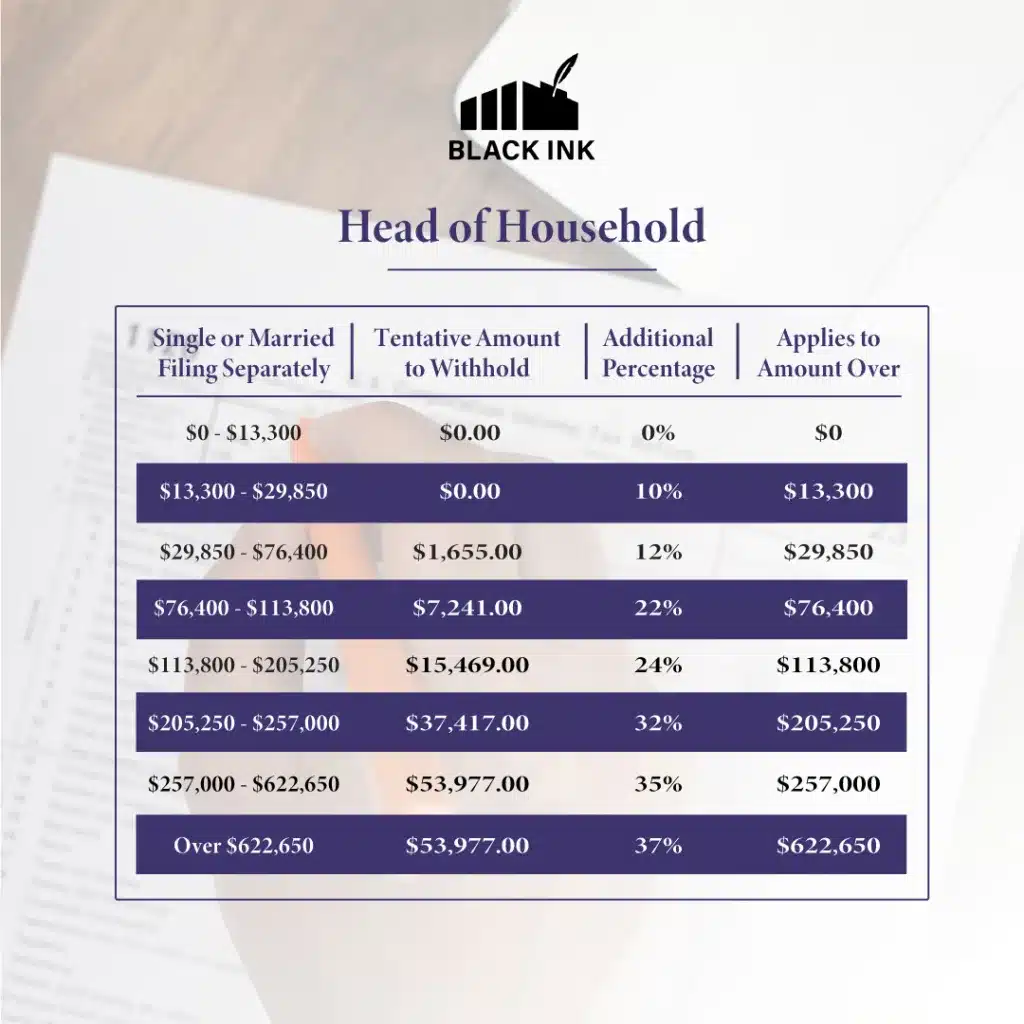

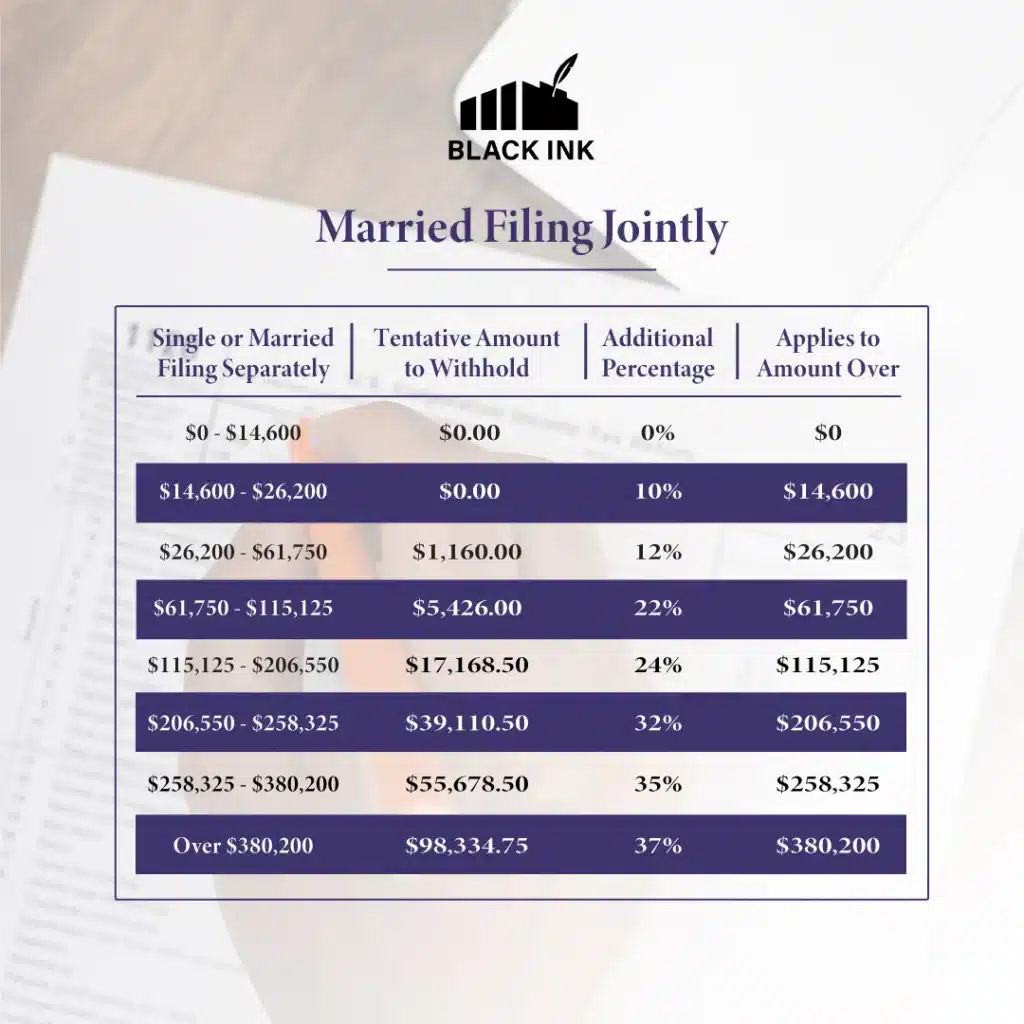

Tax Withholding tables

When managing your business chores, it is important to take in consideration many important factors like payroll. Even though formulating a payroll might look a bit tricky in the starting days, with the right guidance and execution, it can be easy to cruise through this process.

Income tax rate withholding tables for 2024-25

For this, you need to collect some important documents and select a trustworthy and credible payroll system. It is one of the most important factors to successfully implementing payroll which is the IRS withholding tax table for the year 2024-25. This table makes sure that you are correctly withholding taxes for your employees. Make sure that you are using the right resources and support so that you can formulate payroll seamlessly and accurately.

Necessary Federal withholding tax tables iterations in terms of tax withheld

Federal tax withholding tables have changed a lot in recent years, as updated by the Internal Revenue Service. The IRS iterates the income threshold regularly every year with respect to inflation, which can affect tax credits and deductions. This translates to the federal income 2024-25 withholding observing significant changes every year with the ever-increasing tax brackets as well:

- Ever-growing income brackets

- Withholding is not allowed for W4 forms from 2020 and later on

- The availability of a computations bridge for W-4s from 2019 or early on

- Backup withholding rate at a constant 24%

- Supplemental tax is also constant at 22%, which affects the overall tax liability for the tax year.

The federal withholding income tax table for 2023 comprised significantly fewer income brackets as compared to 2024-25. This is what you’ll require for the 2024-25 withholding charts:

- A significant increase for each income segment.

- Withholding allowances are not allowed for W-4s from 2020 and afterward.

- A calculation span is available for W-4s before 2019.

- The withholding rate for backup remains at 24%.

- The supplemental tax rate remains constant at 22%, as specified by the Internal Revenue Service.

2024 IRS Withholding Tables for Automated Payroll Systems

Simplified Withholding Rate Schedules

These tables guide employers using automated payroll systems to calculate federal income tax withholding.

Use these schedules if:

- The employee’s Form W-4 is from 2019 or earlier.

- The Form W-4 is from 2020-25

Income tax withholding tables and federal tax withholding

The IRS withholding tables for the fiscal year 2024-25 utilize an automated payroll system.

In the following table, the first tax table is for people who have a W-4 form from before the year 2019, and for the W-4 from the year 2020 or later on, the step 2 box is not checked:

For people who incorporate a manual payroll system, you can use different tables as compared to those who have an automated payroll system incorporated in their accounting software.

A W-4 form for 2020 or later, and you use a manual payroll system, then you can utilize either of these tables:

- Method categorization for IRS wage bracket from 2020 or later

- Method categorization for IRS percentage for W-4 from 2020 or later

Furthermore, if you incorporate a manual payroll and consist of a W-4 from before the year 2019, you can utilize either of these:

- IRS wage category method table for W4 preceding the year 2019

- IRS percentage method categorization for W4 from 2019 and preceding years.

Keep in mind that restraining allowances is not guided in the W-4s of 2020 and later on, which affects how additional withholding is calculated. Before the iterations, employees had the privilege of obtaining more allowances for minimizing the federal tax withholding. Consequently, the update W-4s, employees can have a limited withholding by using the minimizing worksheet or claiming their reliant.

How to utilize federal withholding tables

Tax Brackets

A federal withholding tax table is generally in the shape of a spreadsheet or table for a better understanding of employers. To evaluate the withholding amount, you have to use a worker W 4 form, filing position, and pay periods. For every new worker at your firm, your business requires a W4 for this endeavor.

Here are the things you’ll need for the collection of federal withholding:

- Important necessary documents

- Employee’s W-4

- Evaluation of payroll data

- Estimation and calculation of the withholding tax

Now, if you need further guidance, we can discuss the withholding tax calculation process in detail as outlined in Publication 15-T.

Gather the required documents for federal income tax.

Gathering all the important documents from your workers is the initial step in correctly calculating withholding tax. For processing withholding tax, you require an employee’s W 4 form, income withholding tax table, gross pay for the period, etc.

The employee’s W4

It’s essential that your employee fills out this form accurately to withhold tax estimations. The worker needs to provide their filing status, people who are dependent on him, and extra income information. This form provides all the references for processing and calculating withholding tax, including any applicable tax credits.

Evaluating payroll records

For the precise calculation of employee withholding tax, you need to evaluate relevant information from the payroll.

For employers, the following aspects are essential in terms of the payroll data:

- Payroll frequency information

- Payroll interval information is crucial for determining the correct additional withholding amount.

- Gross pay quantity for the paying period

An employer has also the responsibility for payroll withholding. This is the amount that is extracted from an employee’s gross wages, impacting their taxable income. This extracted money is then utilized for the payment of payroll taxes required by the federal government.

There are also payroll subtractions that are money extracted from an employee’s pay slips for the payment of allowances. Payroll subtractions are either fixed or mandatory for employers to pay, or optional, which workers can choose to pay as additional withholding.

Getting a grip on payroll can be confusing, this is the reason why implementing a vendor for payroll accounting service to manage the payroll management and make sure each employee is properly paid.

Processing of withholding tax and federal income tax

The last step is to process and accurately calculate withholding tax. Nevertheless, you have to utilize a tax table. In terms of federal income tax, there are different methods used today in 2024-25. These are the percentage method and the wage bracket method.

The method you choose depends on the payroll system you have implemented and whether it accommodates the additional withholding options on the W-4 form.

Wage Category Method

The wage category/bracket method is used for minimizing complexities. This method depicts the accurate amount of money that is for internal revenue with respect to an employee’s tax wages, the quantity of allowances, payroll interval, marital status. This does not involve the processing and calculation to find out federal withholding tax for married filing jointly situations.

GET FREE QUOTE FOR ALL OF OUR SERVICES

Black Ink will send you a free analysis of your current state and what would be the cost of managing either a separate accounting and bookkeeping services or a complete solution across New York, USA. Do get in touch and we will be happy to consult you with our bookkeeping services in NY, New York, USA.